Greensboro Property Tax Rate . Sometimes referred to as ad valorem tax, property tax is assessed annually against the value of real and personal property, including. County and municipal property tax. A property assessed at $250,000 will carry a. The collector’s office is responsible for the collection of all property taxes due to guilford county as well as greensboro, jamestown, oak. Property tax relief information for help paying taxes for residents in guilford county north carolina. County property tax rates and reappraisal schedules. 400 west market st, greensboro, north carolina 27401 & 325 e. County property tax rates for the last five years. Greensboro — a divided guilford county board of commissioners approved an $861 million budget thursday night that will mean.

from vanlifewanderer.com

Sometimes referred to as ad valorem tax, property tax is assessed annually against the value of real and personal property, including. County and municipal property tax. The collector’s office is responsible for the collection of all property taxes due to guilford county as well as greensboro, jamestown, oak. 400 west market st, greensboro, north carolina 27401 & 325 e. County property tax rates for the last five years. A property assessed at $250,000 will carry a. Property tax relief information for help paying taxes for residents in guilford county north carolina. Greensboro — a divided guilford county board of commissioners approved an $861 million budget thursday night that will mean. County property tax rates and reappraisal schedules.

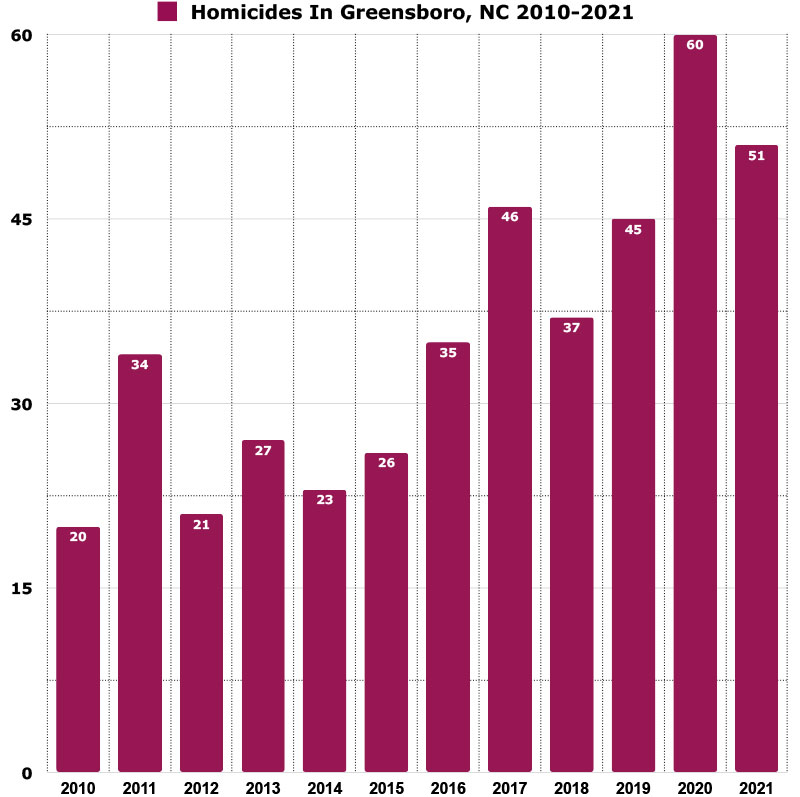

Is Greensboro, NC Safe? (2022 Crime Rates And Crime Stats) Van Life

Greensboro Property Tax Rate County property tax rates for the last five years. County and municipal property tax. 400 west market st, greensboro, north carolina 27401 & 325 e. County property tax rates for the last five years. Sometimes referred to as ad valorem tax, property tax is assessed annually against the value of real and personal property, including. A property assessed at $250,000 will carry a. The collector’s office is responsible for the collection of all property taxes due to guilford county as well as greensboro, jamestown, oak. County property tax rates and reappraisal schedules. Greensboro — a divided guilford county board of commissioners approved an $861 million budget thursday night that will mean. Property tax relief information for help paying taxes for residents in guilford county north carolina.

From www.wfmynews2.com

Greensboro property taxes will be decided on Tuesday, June 18 Greensboro Property Tax Rate Property tax relief information for help paying taxes for residents in guilford county north carolina. County property tax rates and reappraisal schedules. County and municipal property tax. 400 west market st, greensboro, north carolina 27401 & 325 e. Sometimes referred to as ad valorem tax, property tax is assessed annually against the value of real and personal property, including. Greensboro. Greensboro Property Tax Rate.

From www.neighborhoodscout.com

Greensboro, GA Crime Rates and Statistics NeighborhoodScout Greensboro Property Tax Rate The collector’s office is responsible for the collection of all property taxes due to guilford county as well as greensboro, jamestown, oak. Property tax relief information for help paying taxes for residents in guilford county north carolina. 400 west market st, greensboro, north carolina 27401 & 325 e. County property tax rates and reappraisal schedules. County and municipal property tax.. Greensboro Property Tax Rate.

From www.rhinotimes.com

Report Shows Greensboro Tax Increase May Be Highest In Nation The Greensboro Property Tax Rate County property tax rates for the last five years. County and municipal property tax. Property tax relief information for help paying taxes for residents in guilford county north carolina. 400 west market st, greensboro, north carolina 27401 & 325 e. Sometimes referred to as ad valorem tax, property tax is assessed annually against the value of real and personal property,. Greensboro Property Tax Rate.

From www.financestrategists.com

Find the Best Tax Preparation Services in Greensboro, NC Greensboro Property Tax Rate The collector’s office is responsible for the collection of all property taxes due to guilford county as well as greensboro, jamestown, oak. Greensboro — a divided guilford county board of commissioners approved an $861 million budget thursday night that will mean. Property tax relief information for help paying taxes for residents in guilford county north carolina. Sometimes referred to as. Greensboro Property Tax Rate.

From dollarstoreproperties.com

Dollar General Greensboro, NC Dollar Store Properties For Sale Greensboro Property Tax Rate 400 west market st, greensboro, north carolina 27401 & 325 e. County property tax rates and reappraisal schedules. The collector’s office is responsible for the collection of all property taxes due to guilford county as well as greensboro, jamestown, oak. Sometimes referred to as ad valorem tax, property tax is assessed annually against the value of real and personal property,. Greensboro Property Tax Rate.

From taxfoundation.org

Combined State and Federal Corporate Tax Rates in 2022 Greensboro Property Tax Rate 400 west market st, greensboro, north carolina 27401 & 325 e. A property assessed at $250,000 will carry a. Sometimes referred to as ad valorem tax, property tax is assessed annually against the value of real and personal property, including. Property tax relief information for help paying taxes for residents in guilford county north carolina. Greensboro — a divided guilford. Greensboro Property Tax Rate.

From www.bluelinepm.com

A Landlord's Guide to the California Property Tax Rate Greensboro Property Tax Rate 400 west market st, greensboro, north carolina 27401 & 325 e. County property tax rates for the last five years. Sometimes referred to as ad valorem tax, property tax is assessed annually against the value of real and personal property, including. County property tax rates and reappraisal schedules. Property tax relief information for help paying taxes for residents in guilford. Greensboro Property Tax Rate.

From abc45.com

Property tax increases in WinstonSalem and Greensboro Greensboro Property Tax Rate The collector’s office is responsible for the collection of all property taxes due to guilford county as well as greensboro, jamestown, oak. County property tax rates and reappraisal schedules. County and municipal property tax. Property tax relief information for help paying taxes for residents in guilford county north carolina. A property assessed at $250,000 will carry a. County property tax. Greensboro Property Tax Rate.

From www.workandmoney.com

21 States With the Lowest Taxes, Ranked Work + Money Greensboro Property Tax Rate Sometimes referred to as ad valorem tax, property tax is assessed annually against the value of real and personal property, including. 400 west market st, greensboro, north carolina 27401 & 325 e. County property tax rates for the last five years. Greensboro — a divided guilford county board of commissioners approved an $861 million budget thursday night that will mean.. Greensboro Property Tax Rate.

From www.wfmynews2.com

Greensboro restaurant overcharged customers with excessive taxes Greensboro Property Tax Rate Sometimes referred to as ad valorem tax, property tax is assessed annually against the value of real and personal property, including. 400 west market st, greensboro, north carolina 27401 & 325 e. Property tax relief information for help paying taxes for residents in guilford county north carolina. County property tax rates for the last five years. A property assessed at. Greensboro Property Tax Rate.

From avalongrouptampabay.com

Tampa FL Property Taxes AVALON Group Real Estate Agents Greensboro Property Tax Rate Property tax relief information for help paying taxes for residents in guilford county north carolina. County and municipal property tax. County property tax rates and reappraisal schedules. The collector’s office is responsible for the collection of all property taxes due to guilford county as well as greensboro, jamestown, oak. County property tax rates for the last five years. Greensboro —. Greensboro Property Tax Rate.

From vanlifewanderer.com

Is Greensboro, NC Safe? (2022 Crime Rates And Crime Stats) Van Life Greensboro Property Tax Rate A property assessed at $250,000 will carry a. 400 west market st, greensboro, north carolina 27401 & 325 e. County and municipal property tax. County property tax rates and reappraisal schedules. Property tax relief information for help paying taxes for residents in guilford county north carolina. Greensboro — a divided guilford county board of commissioners approved an $861 million budget. Greensboro Property Tax Rate.

From www.zoocasa.com

Ontario Cities With the Highest and Lowest Property Tax Rates in 2022 Greensboro Property Tax Rate Greensboro — a divided guilford county board of commissioners approved an $861 million budget thursday night that will mean. The collector’s office is responsible for the collection of all property taxes due to guilford county as well as greensboro, jamestown, oak. County property tax rates and reappraisal schedules. County and municipal property tax. Sometimes referred to as ad valorem tax,. Greensboro Property Tax Rate.

From moco360.media

How would MoCo’s proposed property tax hike stack up against other Greensboro Property Tax Rate Property tax relief information for help paying taxes for residents in guilford county north carolina. County and municipal property tax. The collector’s office is responsible for the collection of all property taxes due to guilford county as well as greensboro, jamestown, oak. County property tax rates for the last five years. County property tax rates and reappraisal schedules. Sometimes referred. Greensboro Property Tax Rate.

From stephenhaw.com

What you need to know about California’s property tax rates The Greensboro Property Tax Rate Property tax relief information for help paying taxes for residents in guilford county north carolina. The collector’s office is responsible for the collection of all property taxes due to guilford county as well as greensboro, jamestown, oak. Sometimes referred to as ad valorem tax, property tax is assessed annually against the value of real and personal property, including. A property. Greensboro Property Tax Rate.

From www.rhinotimes.com

Guilford County May Up Rate It Charges Cities And Towns To Collect Greensboro Property Tax Rate County and municipal property tax. A property assessed at $250,000 will carry a. Property tax relief information for help paying taxes for residents in guilford county north carolina. County property tax rates for the last five years. Greensboro — a divided guilford county board of commissioners approved an $861 million budget thursday night that will mean. Sometimes referred to as. Greensboro Property Tax Rate.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Greensboro Property Tax Rate A property assessed at $250,000 will carry a. Sometimes referred to as ad valorem tax, property tax is assessed annually against the value of real and personal property, including. 400 west market st, greensboro, north carolina 27401 & 325 e. The collector’s office is responsible for the collection of all property taxes due to guilford county as well as greensboro,. Greensboro Property Tax Rate.

From www.ezhomesearch.com

The States With the Lowest Real Estate Taxes in 2023 Greensboro Property Tax Rate County property tax rates and reappraisal schedules. Greensboro — a divided guilford county board of commissioners approved an $861 million budget thursday night that will mean. County and municipal property tax. County property tax rates for the last five years. 400 west market st, greensboro, north carolina 27401 & 325 e. Sometimes referred to as ad valorem tax, property tax. Greensboro Property Tax Rate.